"Alex and the LF team were key M&A advisers to our predecessor fund Coperniucs, securing valuable portfolio company exits in Croatia (2007) and Serbia (2008), as well as to Abris’ first fund. When Abris expanded with the second fund in 2012, we were happy to take Alex and the LF team in-house. They have made a strong contribution to Abris’ performance, including with the successful Novago investment in municipal waste."

Paweł Gieryński, CIO, Abris Capital

Having worked on behalf of half a dozen private equity funds up to 2011, we thought we understood that industry and how it ticks well enough. So, when most of the LF team joined Abris Capital in 2012, we expected ‘more-of-the-same’. How wrong we were!

Only now can we say ‘been there, done that.’ After 5+ years at Abris Capital, one of the most successful mid-market PE funds in Poland and CEE over the last decade, we now have a well-grounded understanding of how private equity thinks, what makes it thrive, how relentless the pressure to identify value enhancements is, how no stone is left unturned.

While good PE investments are first and foremost based on an attractive company, run by a talented and competent management team, with promising industry dynamics and a compelling competitive advantage and unique selling proposition, financial advisory and financial engineering do have a role to play in improving performance and turning a good investment into a great one.

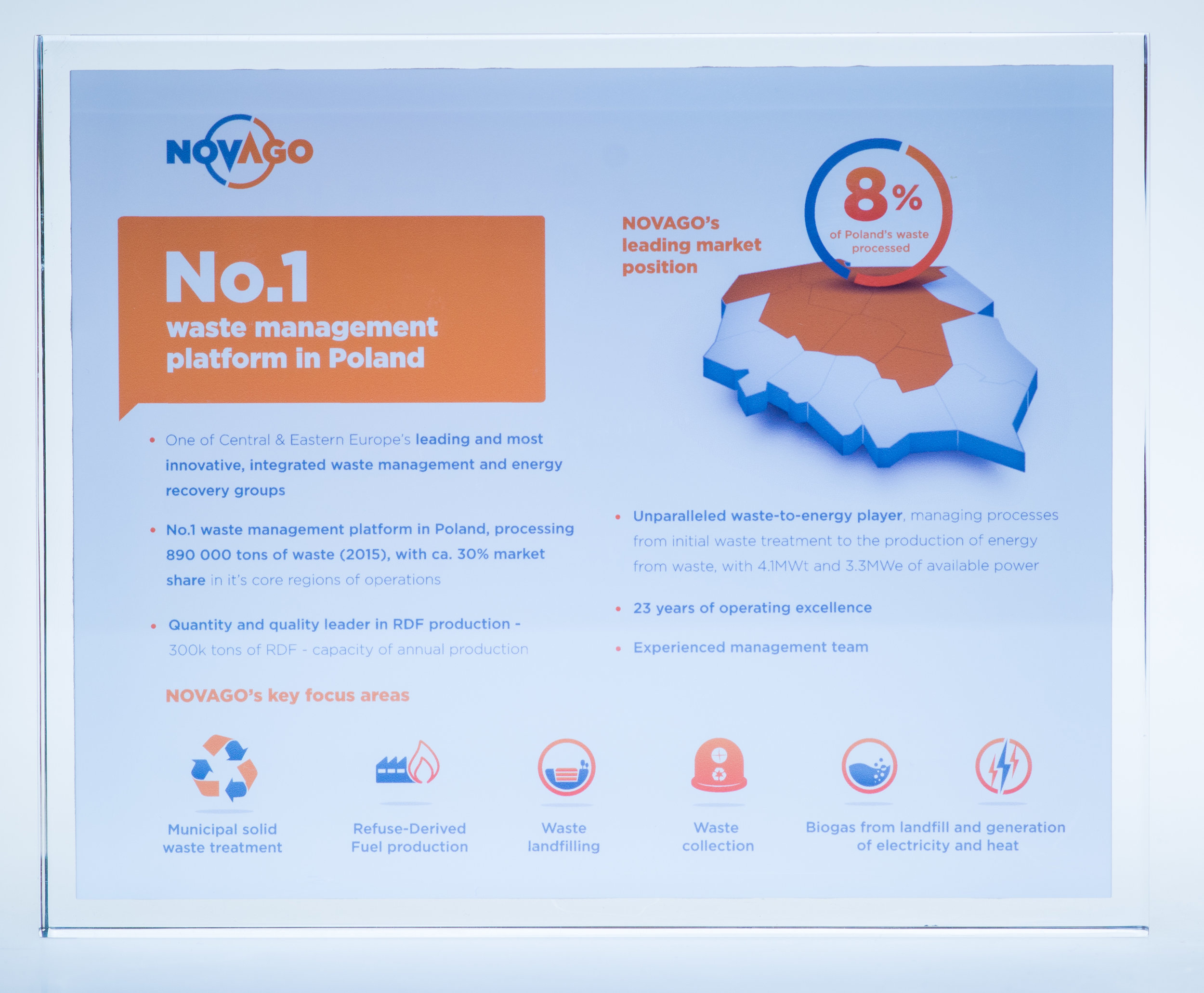

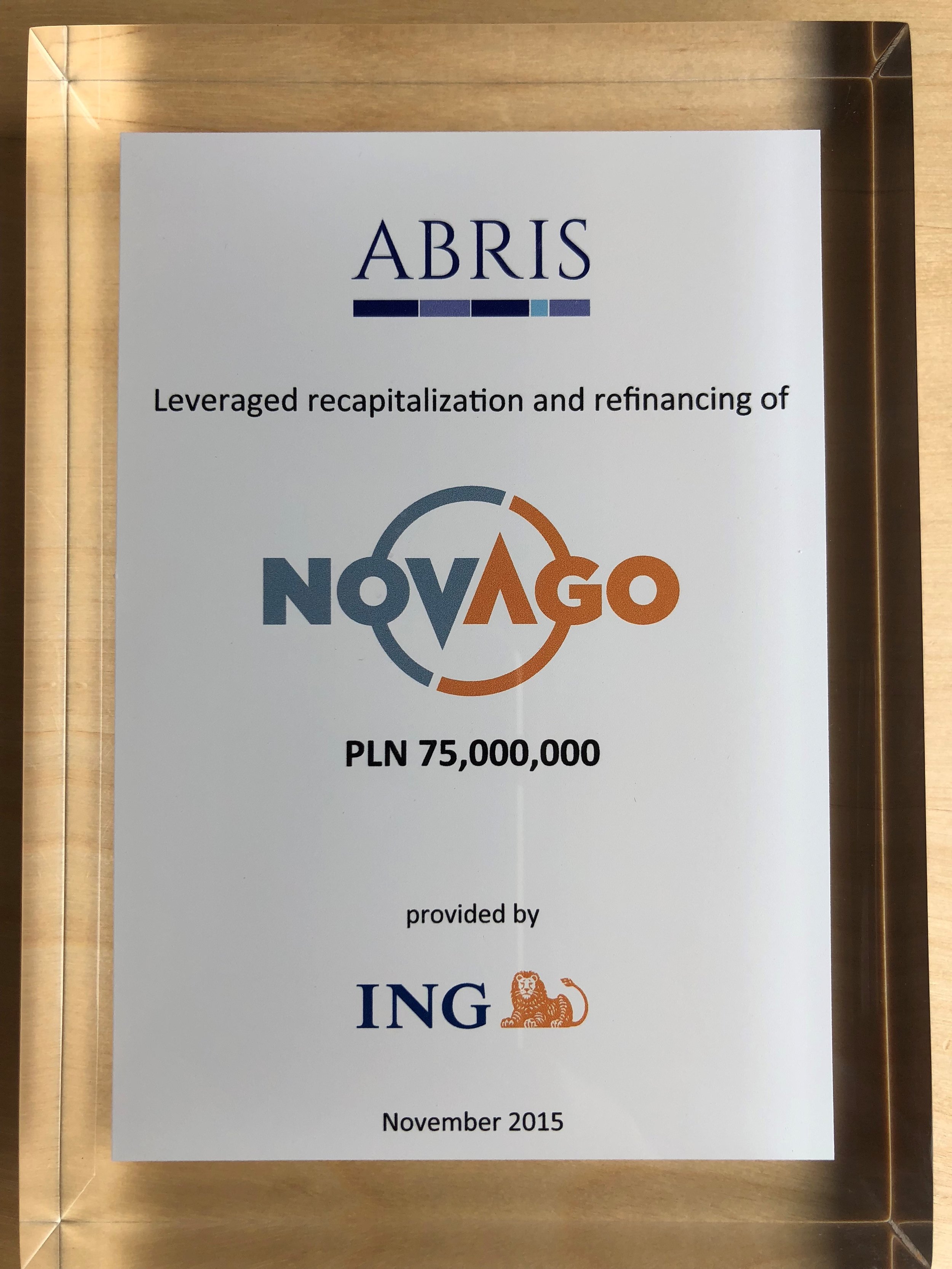

We have completed a range of such mandates and deals, including dividend recaps (Urgent Cargus, in Romania in 2014; Novago, in Poland in 2014 - attached find a short deal presentation), competitive buy-side advisory to secure the pole position for our clients from choosy sellers, running very competitive and structured sell-side auctions and securing high EV/EBITDA multiples as a result for our clients (like leading Romanian IT ERP company Totalsoft sold by us on behalf of SEAF to Global Finance in 2005; other transactions worth highlighting are Adriatic Kabel, sold in Croatia in 2007, as per attached short information, and Progard, sold in Serbia in 2008).

Thus, we are now in a position to put this combined know-how of seasoned financial advisory and experienced private equity activity at the disposal of our clients.