““When we needed a debt advisory team that understood mobile telephony, spoke Spanish, and had dealt with vendors and their banks globally, we called upon Alex and the LF team to secure the long-term debt financing to enable the stellar growth of WOM, Chile’s very successful mobile challenger. Like in Poland for PLAY, they executed well for us time and again.””

When Novator’s telecoms team, PLAY’s launch CEO Chris B., and PLAY’s deputy CTO Stefan E. were visiting Chilean vineyards by helicopter in December 2014, we knew they were up to something! Since neither the British nor the Swedes grow much wine, they must be looking for growth of another, more familiar type! Like another mobile company to disrupt a noncompetitive, oligopolistic market, in order to create compelling services and products for people to get on with their lives, facilitated by great and inexpensive mobile voice and data services.

By May 2015, Alex was in Santiago de Chile for the first time, taking a detailed look as to how to raise bank financing for the company acquired, Nextel Chile, where American investors had managed to burn through USD 1 billion of cash and had nothing to show for it but 200k subscribers, 1,000 base stations, a handful of empty stores, 600 demotivated staff, and a near-bankrupt company.

Well, Chris and his successor Joergen, and their teams, supported by Novator’s seasoned experts, had built the most acclaimed European mobile challenger in PLAY, so ‘more of the same’ was not going to be on the cards once Novator bought the company in January 2015, and Chris rebranded it into WOM (for ‘Word of Mouth’) in July 2015.

As of mid-2018, WOM has exceeded 4m subscribers in this 18m population market, adding on a monthly basis more than Nextel bequeathed to Novator, with 2,000 highly motivated employees, 200+ stores where customers queue to be served, and a kick-ass brand that has taken young Chile by storm.

Prices for mobile data have dropped by 96% thanks to WOM's aggressive price positioning. The price for 1GB has declined from CLP 28k (~USD 45) as of May 2015 to CLP 1k (~USD 1.7) as of October 2017, as a result of WOM’s value-for-money market offerings. Given the importance of mobile internet for hundreds of thousands of small business and home office workers, the impact of this quantum leap in competitive mobile services cannot be overstated.

Chile, which is a wonderful country blessed by nature, and which for many years was relatively isolated in Latin America thanks to the high Andes mountains on its eastern border with Argentina, has recovered from the Pinochet dictatorship of the 1970s and 1980s. But in the structure of many of its industries, the old regime still casts a shadow, with limited levels of competition among a few oligopolistic companies in many sectors. WOM's hugely successful and relished push for more value, transparency, customer benefits and consumer choice has opened up awareness in Chile about how more competition might benefit society across a range of industries. WOM has just been named among the top 10 preferred employers in Chile, a mere three years after being reinvented.

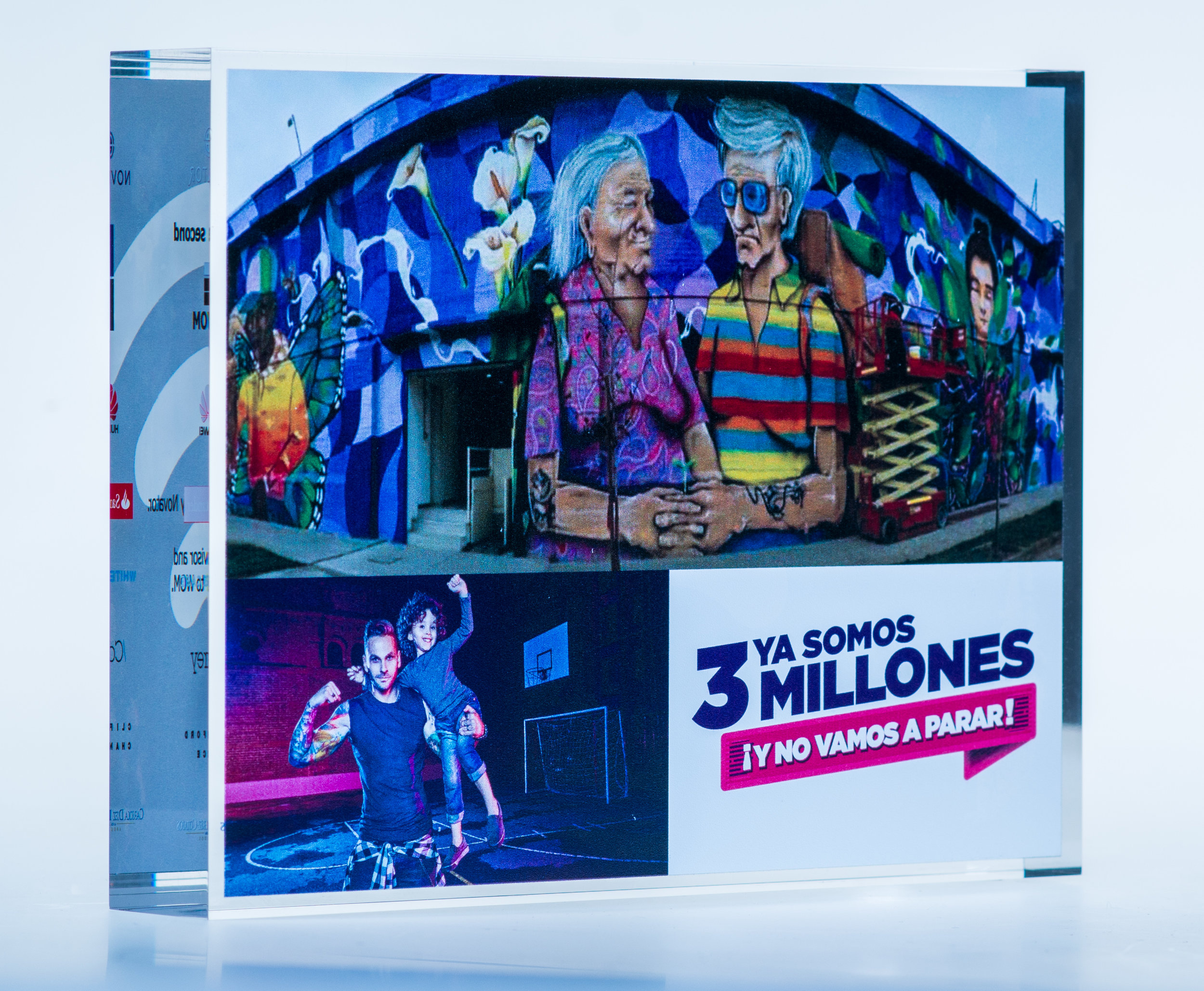

The LF team working on WOM mandates, proudly modeling our Chilean dress code

The LF Team advising WOM and Novator, comprised entirely of PLAY veterans and alumni, and led for the most part by Piotr Jegier, has been privileged to work with WOM's management team and Novator, as well as withWOM's competitively chosen vendors and their banks, to structure three attractive senior financings exceeding USD 300m, in order to finance the build-out of WOM's 4G mobile network. This has no doubt been LF’s most global project to date, with a Chilean borrower and Chilean lawyers in Latam, English-law lawyers in London and Hong Kong, the vendor and its bank in Shenzhen and Beijing – and many days at most one hour of daylight shared between these three time zones for the umpteen confcalls necessary to get the deal to the finish line. There’s nothing a good team based in Warsaw cannot get done!

Epilogue on WOM Chile (Dec 2024)

LF stopped advising WOM (Chile) in 2019, when it ‘graduated from LF’ and started working with JPM and Santander on two high yield bonds, raising USD 600m in 2019 and another USD 450m in 2021. (See attached short presentation for details)

The company went from strength to strength in the marketplace, beating CLARO and taking over MOVISTAR to take the #2 position, as this 2023 table sourced from Chilean telco regulator Subtel illustrates (link).

That strong operational performance was rewarded by the financial markets, with WOM (Chile) raising not just USD 1,050m through the two aforementioned high yield bonds but also selling up to 4,000 telecom towers for USD 930m in 2021 to Phoenix Towers in a deal advised on by Citi, allowing the shareholders to pay themselves a large dividend.

Unfortunately, a number of missteps led subsequently to a situation of liquidity constraints, which caused significant damage to the franchise and great distress to its various stakeholders in 2023/24. While not all circumstances are public knowledge, the key factors in that unfortunate sequence of events that are public domain are the following:

1. WOM had won important 5G 700MHz spectrum in the 2021 Chilean spectrum auction, but committed itself to ambitious roll-out and coverage targets. (link)

2. That added a third capex challenge, on top of the ongoing FTTH roll-out for convergent fixed broadband/triple play services and a southern fiber optic cable supported by a Chilean government subsidy. (link)

3. The company appeared to struggle with these challenges, as can be inferred from several changes of key management members in 2023/24. (link)

4. The Chilean government put WOM (Chile) on notice that it was at risk of non-compliance with its coverage targets as early as October 2022, when a first milestone check was missed. (link)

5. Further complications were added by the market’s perception of increased political risk in Chile further to the election of a leftwing president in November 2021. With US interest rates rising sharply in 2022, financial conditions including refinancing options for a non-investment-grade borrower like WOM (Chile) were becoming more challenging from 2022.

6. With WOM (Chile) having significant senior leverage of 3-4x debt/ebitda as a result of the high yield bonds and the special 2022 dividend, the margin for capex and cash flow errors was small. (see chart below from WOM’s IR materials)

7. In March 2023, the company made a public announcement that WOM (Chile) would invest USD 100m into its Colombian sister company WOM (Colombia). (link). The bond markets did not take the announcement well, with WOM (Chile)’s bonds starting to trade at double-digit discounts to its par value, especially the first HY bond with outstanding balance of approx. USD 348m due for repayment/refinancing in November 2024.

8. A couple of months later the liquidity issues became fully transparent, as reflected in WOM (Chile)’s quarterly report of Q3 2023, where leverage and free cash flow indicators were flashing red (see enclosed material). At more or less the same time, the Chilean government notified WOM (Chile) and the markets about the company missing coverage targets for both its 5G spectrum license and the national fibre rollout. (link)

9. The sponsor decided on radical action, bringing ‘Tio WOM’ back in October 2023, i.e., Chris Bannister, the founding CEO of both WOM companies, who promptly announced that WOM (Chile) would not make any further investments into WOM (Colombia) above and beyond the USD 16m disbursed from its March 2023 commitment. (link)

10. Throughout Q4 2023 and Q1 2024 refinancing efforts were ongoing at WOM (Chile). After 31.12.2023, the high yield bond due in November 2024 was classified as short-term debt in the financial accounts, with further downgrades ensuing from rating agencies. (link)

11. By the end of Q1 2024, the sponsor decided to take drastic action. In short order, it relieved Chris Bannister of the CEO role (31 March 2024) and proceeded to put WOM (Chile) into US Chapter 11 (1 April 2024), with a USD 200m JPM Debtor-in-possession financing. (link)

12. In December 2024, the company announced that it had reached a deal with its creditors, as a result of which the ‘Ad Hoc Group’ of bond holders led by Blackrock, Moneda and others is due to inject USD 500m of new funds, agree to a partial debt-equity swap, and take full ownership of WOM (Chile) (link to announcement; link to full US Chapter 11 Information). The deal is expected to close by March/April 2025. Prior sponsor Novator Partners will likely lose all of its equity. The bond markets took the news positively, as can be inferred from the trading volumes of the bonds post-announcemernt. (link)

A similar perspective was provided in a May 2024 credit research note by an analyst at New Street Research covering WOM (Chile)’s high yield notes, who observed: “ WOM Chile filed for Chapter 11 last month (April 1), followed a couple of weeks later by a local filing for WOM Colombia. Colombia’s relatively modest financing difficulties were likely sealed by the Chilean filing and we review events in Chile to work out how a seemingly successful scaled wireless operator (close to 25% market share of service revenue, 37% EBITDA margins) ended up here. Asset quality is not the issue, we think, rather a liquidity crunch as rates rose which couldn’t be overcome - and despite leverage which optically at least wasn’t so alarming.” (for the full analysis see this link)

LF was a bystander to these Chilean events, but laments the financial distress, the loss of reputation, the large financial loss of its former client, and the distress and losses suffered by the many employees, suppliers, creditors and other stakeholders of WOM Chile, including long-standing business partners Huawei and Sinosure.

On the positive side, WOM (Chile) is likely to now have the ability to continue excelling in the market place in Chile, with four mobile operators providing strong competition with multiple consumer benefits. The government is expected to give the company sufficient time to meet its incomplete 5G roll-out obligations and to increase coverage and internet availability throughout Chile.