““When Alex pitched the idea of a 4th mobile operator to us in 2004, we were already eyeballing Poland. During a partnership lasting 8 years, we built PLAY into the most successful European mobile challenger, with LF responsible inter alia for raising over USD 800m of competitively-sourced senior vendor financing in several financing rounds.””

At LF, we believe in ‘sticking to your knitting’. If we don’t know a sector well or are not confident that we can learn it quickly, we will not advise. It is not good enough to be a generalist in our industry, one either has a very solid understanding of the industry dynamics in a given sector and can thus speak with authority, or it is best left for others to do the job.

While the Elektrim job ended badly, over 24 months it afforded Alex the ability to complete a couple of MBAs-on-the-job, one in mobile telephony. Wedged between JV partners Deutsche Telekom (an incumbent) and Vivendi (a challenger), one learned all about the arguments between fighting for market share (by investing in subscribers, the Vivendi perspective) and harvesting market share for cash (by decelerating growth, the DT perspective). Never a dull moment, and a key role as part of ERA GSM’s UMTS committee, ensuring our mobile operator won one of three 3G licenses in 2001, the start of the mobile internet story that has transformed our lives forever; one key objective at the time was to avoid a 4th entrant, by not allowing Polish listed alternative telecom operator Netia to gain a 4th license - which we achieved.

Well, often in life, what goes around comes around. By 2004 LF was advising Netia S.A., which was strong in fixed telephony and had some fixed internet, on its bid to gain Poland’s 4th UMTS license in a new public tender, competing against the likes of Hutchinson Whampoa from Hong Kong, which had started 3G in Sweden, the UK and Italy among others, as a well-funded challenger. LF was charged with running the project, writing the first business plans, identifying possible industrial and financial partners, pitching to co-investors, and commencing discussions with equipment vendors (Ericsson, Nokia, Siemens, Alcatel, Lucent, Huawei, ZTE and others) on network buildout and vendor financing options.

The company, which today is known as PLAY and is listed on the Warsaw Stock Exchange, was no more than a blueprint in 2005 when we started. Today it has over 15 million subscribers, over EUR 1.5 billion in annual revenues, and has beaten former Vodafone affiliate PLUS, former no. 1 T-Mobile Poland (which was #1 when it was co-managed by Elektrim!), as well as the fixed-mobile integrated incumbent Orange into the #1 position in the country, earning plaudits as the most successful mobile challenger in Europe. Credit goes in particular to the very talented and cohesive management team (some of which LF helped to recruit), and to the enlightened and very hands-on shareholders from both London-based fund Novator and Greek mobile phone retailing entrepreneur Panos Germanos, who together still control the company post-IPO.

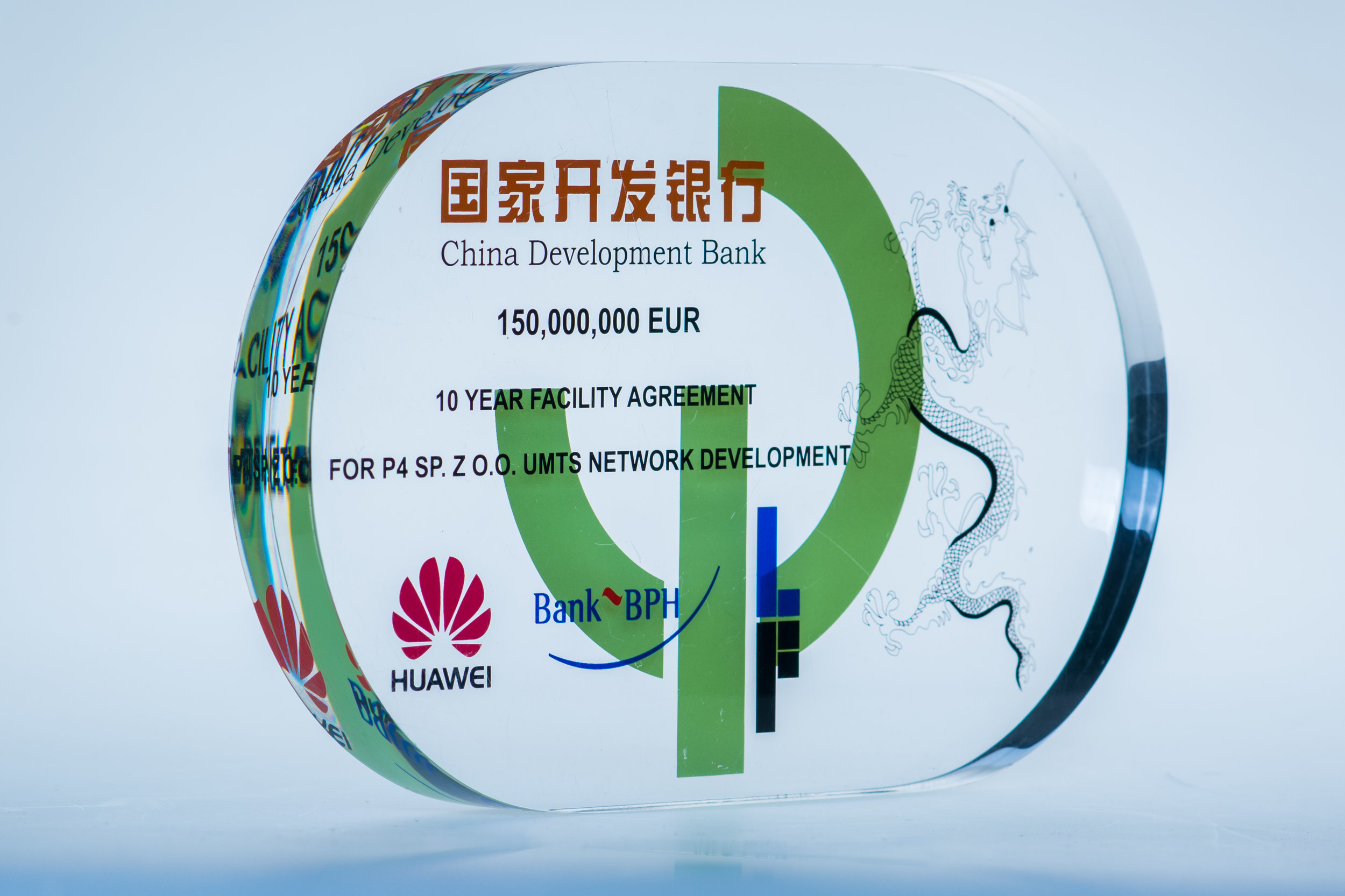

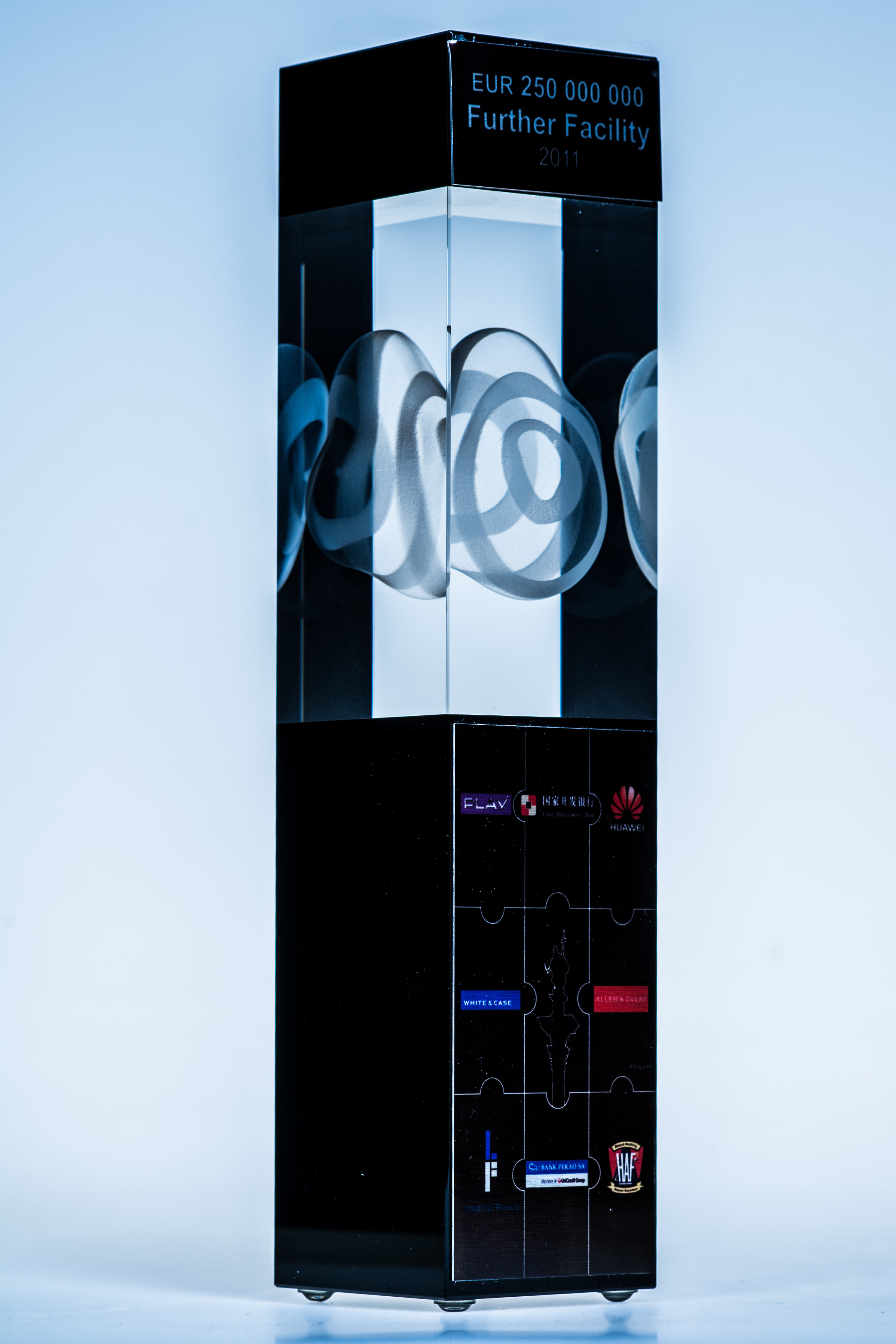

But LF did play a key role, starting in 2005 with the business plans, winning Novator as a co-investor with a EUR 200m investment, winning the license by just outbidding Hutchinson, and going on to win Huawei as a key vendor, structuring four rounds of competitive vendor financing totaling in excess of USD 800m from 2006 through 2011.

The LF team on PLAY included many of our stars, including some senior telecom executives, such as the current CFO of Polish telecom infrastructure player Emitel, Alek Skolozynski, the former CFO of T-Mobile Croatia and Emitel, Kent Holding, as well as project finance banker Tomasz Maj, who eventually reverted to his oil and gas roots, running North Sea Oil assets for Talisman / Repsol Sinopec.

Eventually, PLAY outgrew us, and JP Morgan refinanced all of the senior financings structured by LF over a near-decade of work with Chinese development banks through one of the biggest and most successful high yield bonds in 2014, a EUR 870m & PLN 130m high-yield bond. Today, we are proud clients of PLAY and consider it one of the most successful results of good advisory work, a real company employing in excess of 2,000 people that did not exist when we started out together (please see PLAY's reference letter).